Cost of money refers to the average interest rate at which you are able to borrow money. Think of the cost of money as the rent you have to pay for using someone else’s money.

Yes, there is a cost of money even if you are using all of your own money. How? Since you are using your own money instead of putting it into a savings account, you are foregoing the 1.5% interest you could make on it. Thus, the cost of money in this case is 1.5%.

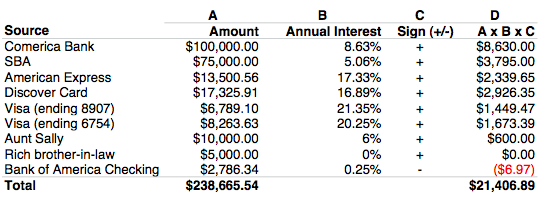

As a small business owner, you probably borrow money from several sources, e.g., bank, credit cards, friends. You probably also keep money in various places, e.g., checking account, savings account. Each of these sources has its own cost of money: A bank loan could cost you 10%, a credit card could cost you as much as 30%, and so on and so forth. So how do you come up with the combined cost of money that tells you how much interest you are paying for all of this borrowed money?

The short answer is that your cost of money is the weighted average of your borrowing and deposit interest rates. Too much jargon? Don’t worry. In the next section I will explain how to calculate your cost of money in 4 simple steps.

4 Simple Steps to Calculate the Cost of Money for Your Small Business

Let us create a spreadsheet with 4 columns.

Step 1 (Column A) – Identify all of the sources of money for your business and list them in order. These sources are often:

- Small business loans from a bank or SBA.

- Credit cards. If you use multiple credit cards, then list the amounts your have charged on each one of them separately. (Note: Do not list your credit limit, but rather your outstanding balance. If your outstanding balance changes every month, your cost of money will also change every month.)

- Friends or family who have lent you money to run your business. (Write down the amount even if they are not charging you any “interest” on the loan.)

- If your business has cash lying in a checking or saving account, list that too.

Step 2 (Column B) – Next to each source, write down the interest rate you are paying. For SBA, this rate can be easily found in your documents. If you use multiple credit cards, write down the APR of each card separately. You can find out the APR from your credit card statements, or you can call the credit card companies.

Step 3 (Column C) – Apply a + or – sign to each source.

- If your business has “borrowed” money from that source, then use a + sign. Bank loans, SBA loans, Credit cards, Friends/Family will get a + sign.

- If you business has “deposited” money into that source, then use a – sign. Your business checking account balance and your savings account balance will all have – signs.

Step 4 (Column D) – Time to find your weighted average. You can do this by simply multiplying column A with Column B, and applying the sign in Column C to get Column D. (See table below.)

Once you finish Step 4, now, add all of the rows in Column A and all of the rows in Column D. After you do that, divide the Column A total by the column D total. This amount is the cost of money for your business. Simple, huh?

Cost of Money = $21,406.89 / $238,665.54 = 0.0897 = 8.97%

As you can see, the cost of money is the weighted average interest rate for the money supply into your business.

Applying cost of money as a metric

Cost of money is a very useful metric in making business decisions. For example, cost of money can be used to decide whether to offer / accept early payment discounts.

About the author

About the author

Jagath Narayan is the CEO and co-founder of Ordoro, the #1 ecommerce platform for retailers growing from 10 orders/day to 10,000 orders/day. Follow him on LinkedIn to learn more about Entrepreneurship and Ecommerce.